Business Insurance in and around Lexington

One of the top small business insurance companies in Lexington, and beyond.

No funny business here

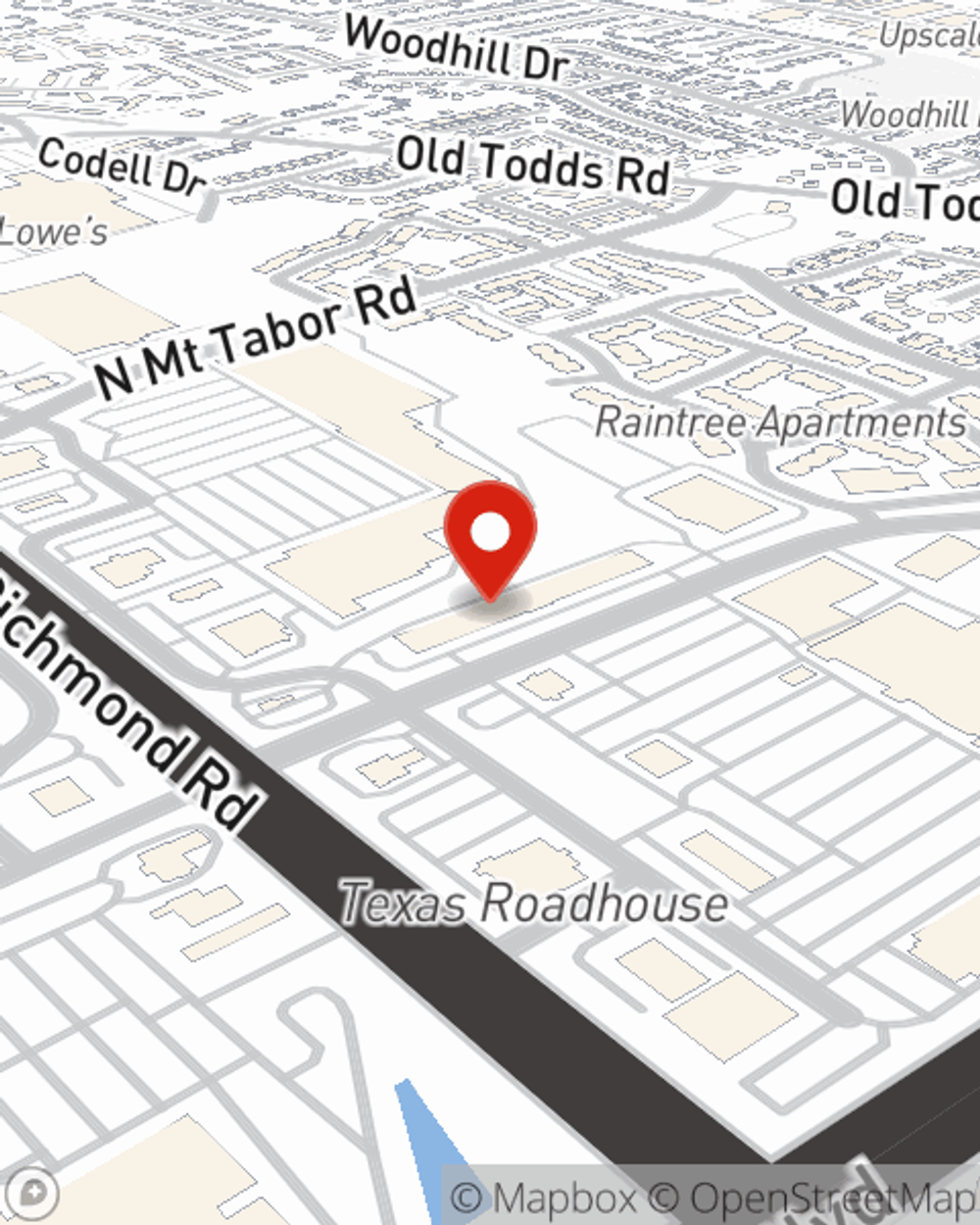

- Fayette County

- Richmond Road

- Man O War

- Central Kentucky

- Nicholasville

- 40509

- North Locust Hill Dr

Business Insurance At A Great Value!

Running a small business is hard work. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, contractors, specialized professions and more!

One of the top small business insurance companies in Lexington, and beyond.

No funny business here

Get Down To Business With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Gina Hopper. With an agent like Gina Hopper, your coverage can include great options, such as commercial auto, business owners policies and artisan and service contractors.

Let's chat about business! Call Gina Hopper today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Gina Hopper

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.